Identity & financial monitoring

We provide advanced monitoring, near real-time alerts, and customized emerging fraud notifications, so subscribers can rest easier knowing their identity is protected.

Unbeatable customer care

Our U.S.-based support team is available 24/7 to assist potential fraud victims, and our highly-trained remediation experts won’t stop until a victim’s identity has been fully restored.

$2 million expense reimbursement†

We offer plans that include $2 million in fraud expense reimbursement, which can be used toward legal fees, child care, and other costs that might be incurred due to identity theft.

Strongest family protection

Say goodbye to traditional family plans that discriminate against age and residency requirements. Our family plans ensure the whole family is protected.

Complete cybersecurity*

Be ready for what's next with superior cyber protection that includes ransomware expense reimbursement, plus mobile device security tools such as malware detection, Wi-Fi network security scans, safe browsing and phishing protection.

Financial monitoring & protection

You worked hard for the money. We work hard to keep it safe, with features like HSA and 401(k) monitoring, stolen funds reimbursement, and high-risk transaction monitoring.

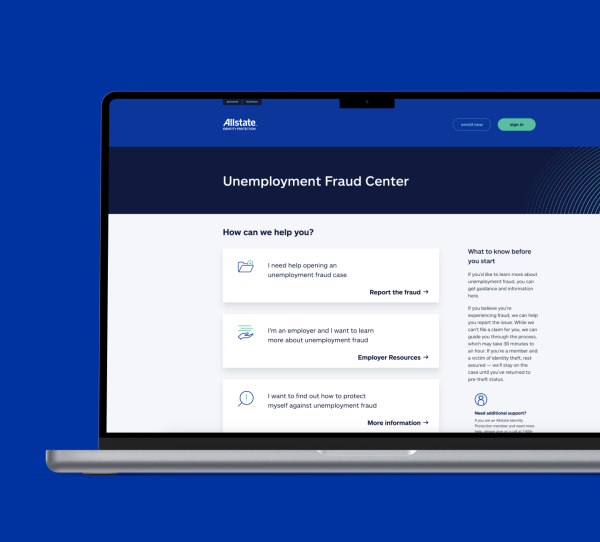

Agile solutions for rapidly changing threats

Get the resources you need, when you need them. The Unemployment Fraud Center — a free and on-demand tool businesses can use with all employees, regardless if they're participants — helps relieve the burden on HR teams brought on by surging unemployment fraud.

New proprietary technology

Introduced in 2019, the Allstate Digital Footprint℠ is a first-of-its kind technology that allows subscribers to see their data in meaningful new ways. This year marks the launch of Allstate Security Pro℠ — personalized content that warns users of new types of fraud that might target their age range, location, or other subscriber-provided data.